The CPA Evolution initiative is transforming the CPA licensure model to recognize the rapidly changing skills and competencies the practice of accounting requires today and will require in the future. It is a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA).

The AICPA Governing Council and the NASBA Board of Directors have both voted to support advancing the CPA Evolution initiative. NASBA and the AICPA are moving forward with implementing a new core + discipline CPA licensure model, and will launch a new Uniform CPA Exam in 2024.

If you have any questions, please reach out to us at cpaexam@nasba.org.

Click through to watch our short video about the new CPA licensure model

Recent News

More News

AICPA, NASBA publish revised CPA Evolution Model Curriculum – Journal of Accountancy Nov 19, 2021

Content for redesigned CPA Exam takes shape – Journal of Accountancy Jul 7, 2021

Closing the skills gap in accounting – Accounting Today June 21, 2021

AICPA, NASBA launch CPA Evolution Model Curriculum – Journal of Accountancy June 15, 2021

AICPA, NASBA unveil CPA Evolution curriculum – Accounting Today June 15, 2021

CPA Evolution Model Curriculum FAQs – Journal of Accountancy May 4, 2021

AICPA, NASBA to unveil new CPA Evolution curriculum in June – Accounting Today Apr 26, 2021

Do colleges prepare future CPAs? Three key insights – AICPA Insights Mar 17, 2021

College Accounting Programs Need to Update Curricula: AICPA-NASBA Mar 17, 2021

New CPA licensure model embraces core, deeper knowledge – Journal of Accountancy Jul 30, 2020

CPA licensure: One step closer to change – AICPA Insights Jul 30, 2020

NASBA votes to advance CPA Evolution initiative with AICPA – Accounting Today Jul 28, 2020

NASBA Board makes crucial decision on CPA Evolution – NASBA Jul 27, 2020

UAA Model Rule changes proposed in support of CPA Evolution – Journal of Accountancy May 27, 2020

NASBA releases proposed revisions to Uniform Accountancy Act Model Rules – NASBA May 26, 2020

AICPA Council approves CPA Evolution model – Accounting Today May 21, 2020

Another step closer to evolving CPA licensure – AICPA Insights May 21, 2020

AICPA Council supports advancement of new CPA licensure model – Journal of Accountancy May 20, 2020

Preparing accounting students for a changing profession – AICPA Insights May 15, 2020

About NASBA

Since 1908, the National Association of State Boards of Accountancy (NASBA) has served as a forum for the nation’s Boards of Accountancy, which administer the Uniform CPA Examination, license more than 650,000 certified public accountants and regulate the practice of public accountancy in the United States. NASBA’s mission is to enhance the effectiveness and advance the common interests of the Boards of Accountancy in meeting their regulatory responsibilities. The Association promotes the exchange of information among accountancy boards, serving the needs of the 55 U.S. jurisdictions. NASBA is headquartered in Nashville, TN, with a satellite office in New York, NY, an International Computer Testing and Call Center in Guam and operations in San Juan, PR. To learn more about NASBA, visit www.nasba.org.

About the AICPA

The American Institute of CPAs (AICPA) is the world’s largest member association representing the CPA profession, with more than 429,000 members in the United States and worldwide, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession. To learn more about the AICPA, visit www.aicpa.org.

NASBA and the AICPA carefully reviewed feedback received from more than 3,000 stakeholders across the profession, studied other professions’ licensure models and considered multiple options for updates to the licensure model before developing the below CPA licensure model, which we expect to launch in 2024. We believe this new licensure model is responsive to stakeholder input and will propel the profession into the future.

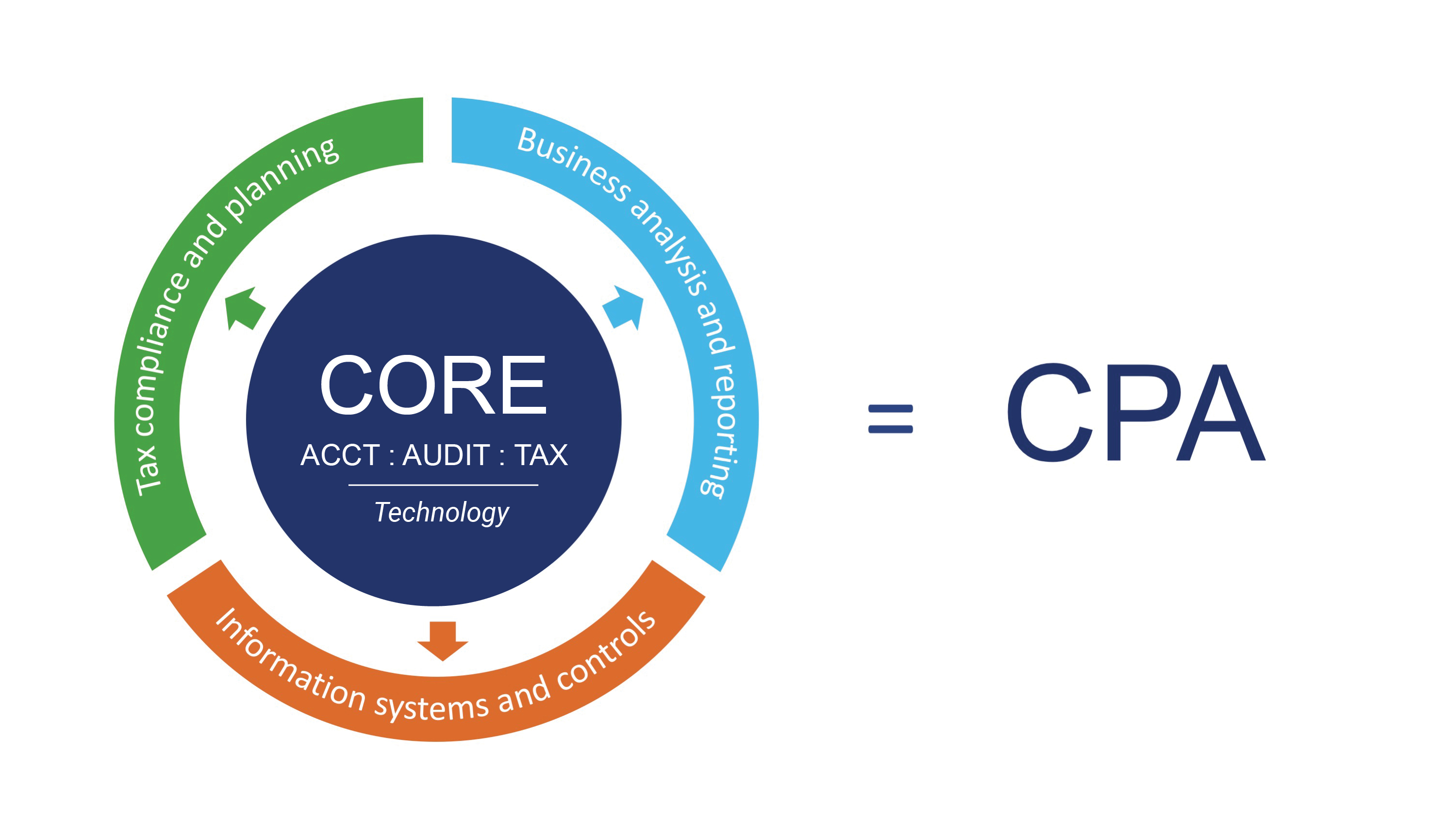

The new CPA licensure model is a core + discipline licensure model. The model starts with a deep and strong core in accounting, auditing, tax and technology that all candidates will be required to complete. Then, each candidate will choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, this model leads to full CPA licensure, with rights and privileges consistent with any other CPA. A discipline selected for testing does not mean the CPA is limited to that practice area.

For more information about the proposed model and why our two organizations believe it is the best approach for CPA licensure, read the FAQs below and download a summary of the initiative here.

NASBA and the AICPA carefully reviewed feedback received from more than 3,000 stakeholders across the profession, studied other professions’ licensure models and considered multiple options for updates to the licensure model before developing the new CPA licensure model, which we expect to launch in 2024. We believe this new licensure model is responsive to stakeholder input and will propel the profession into the future.

As part of the CPA Evolution initiative, the leadership of NASBA, in collaboration with the AICPA, determined that the Uniform Accountancy Act Model Rules around educational requirements for licensure needed to be updated to incorporate additional subjects and skills reflective of the evolving profession and create more consistency. Those changes, which were endorsed by AICPA’s Board of Directors, were exposed for public comment and ultimately issued as final model rules by NASBA in October 2020. You can find the final rules here.

The AICPA Governing Council and the NASBA Board of Directors voted to support the CPA Evolution initiative. We will launch a new Uniform CPA Exam in January 2024.

NASBA and the AICPA will continue to work collaboratively with stakeholders from across the profession to implement this new licensure model. We are eager to move forward with a core + discipline model to meet the needs of the profession and the public.

Q: What is CPA Evolution? (+) Show answer

The CPA Evolution initiative is transforming the CPA licensure model in recognition of the rapidly changing skills and competencies practice requires today and will require in the future. It is a joint effort of the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA).

Q: What is the new model for CPA licensure? (+) Show answer

A: NASBA and the AICPA believe the following approach is responsive to stakeholder input while still moving the profession forward for the future.

The leadership of NASBA and the AICPA are moving forward with a core + discipline licensure model. The model starts with a robust core in accounting, auditing, tax and technology that all candidates will have to complete. Then, each candidate will choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of a candidate’s chosen discipline, this model leads to a full CPA license, with rights and privileges consistent with any other CPA. A discipline selected for testing does not mean the CPA is limited to that practice area.

The anticipated disciplines reflect three pillars of the CPA profession:

Q: Why did NASBA and the AICPA develop a core + discipline licensure model? (+) Show answer

A: This model provides numerous benefits for positioning the profession for the future amidst an ever-changing business environment:

Q: Why does CPA licensure need to evolve? (+) Show answer

A: The environment in which CPAs operate is changing at a rapid pace.

As complexity in the marketplace has increased, the body of knowledge required for newly licensed CPAs has expanded. For example, today there are three times as many pages in the Internal Revenue Code, four times as many accounting standards and five times as many auditing standards as there were in 1980.

Procedures historically performed by newly licensed CPAs are being automated, offshored or performed by paraprofessionals. Now, entry-level CPAs are performing more procedures that require deeper critical thinking, problem-solving and professional judgment, and responsibilities traditionally assigned to more experienced personnel are being pushed down to the staff level.

While technological innovations are creating new opportunities for CPAs, they are also serving to expand the requisite skillset for new licensees, who need a deeper understanding of systems, controls and data analysis to execute their responsibilities.

As a result, newly licensed CPAs need to know more than ever before to meet the needs of practice. However, the Uniform CPA Examination® (“Exam”) and education requirements can only cover so much information in our current model for CPA licensure.

All of these changes have led NASBA and the AICPA to consider if the CPA licensure model should be updated to continue to equip newly licensed CPAs with the skills and competencies needed as practice evolves. NASBA and the AICPA believe the profession must embrace these changes to maintain its relevance and support evolving business and firm needs while continuing to serve the public interest.

That’s why NASBA and the AICPA are working to evolve licensure requirements for new CPAs: so the profession can continue to effectively meet the needs of organizations, employers and the public.

Q: Who else is involved in the CPA Evolution project? (+) Show answer

A: CPA Evolution is a profession-wide effort. Along with NASBA and the AICPA, state CPA societies, state boards of accountancy, academia, firms of all sizes and CPAs in all areas of practice from across the country are vital partners in preparing the profession for the future. Their collaboration and support in implementing the new CPA licensure model will help the profession remain strong and relevant while protecting the public interest in a constantly changing business environment.

Q: How have NASBA and the AICPA been working with these stakeholders? (+) Show answer

A: In 2018, NASBA and the AICPA sought feedback on an initial licensure concept from stakeholders across the profession. The two organizations also formed a working group of stakeholder representatives to provide further perspective.

After reviewing this feedback, NASBA and AICPA leadership drafted five guiding principles to inform the creation of a new licensure model. Throughout spring and summer 2019, NASBA and the AICPA sought input on the principles from stakeholders throughout the profession, academia and the regulatory community. NASBA and the AICPA held discussions with a wide variety of stakeholder groups, met with NASBA and AICPA committees, spoke with state boards of accountancy and state CPA societies and asked for input from AICPA members and state board licensees.

In June 2019, NASBA and the AICPA launched a joint website, EvolutionOfCPA.org, where they shared the guiding principles with the broader profession. The two organizations launched a communications campaign asking stakeholders to share their feedback by August 9, 2019.

Throughout Fall 2019 and Spring 2020, NASBA and the AICPA held over 20 more discussion groups with stakeholders from across the profession.

NASBA and the AICPA continue to engage with stakeholders as the implementation process progresses by holding discussion groups, requesting feedback on resources and sharing updates.

NASBA and the AICPA have heard input from over 4,000 stakeholders thus far.

Q: What feedback did NASBA and the AICPA receive? (+) Show answer

A: The number one comment received was support for the need to change licensure. Most respondents also supported a greater emphasis on technology skills and knowledge as a prerequisite for licensure. Respondents said CPA licensure should emphasize and be built around a strong core of accounting, auditing, tax and technology.

NASBA and the AICPA also heard that evolving licensure would bring needed skills to the profession, position the CPA for the future and protect the public interest.

The feedback included questions about the specifics of implementing a new licensure model, such as how core CPA knowledge would be defined, how education requirements might be modified and how licensure changes would be affected in the current legislative environment.

The original driver behind CPA Evolution was the impact of technology on the profession. In the feedback they received, NASBA and the AICPA also heard an underlying theme that, while greater technological expertise should be required for licensure, there are other factors disrupting the profession as well. The effort to evolve the licensure model should focus more broadly than just attracting those with technological and analytical skills to become CPAs; it should be about ensuring the CPA license remains fit for purpose to assure continued public protection. NASBA and the AICPA needed to think bigger.

Q: What did NASBA and the AICPA do with that feedback? (+) Show answer

NASBA and AICPA leadership carefully reviewed all of the feedback received, studied other professions’ licensure models and considered multiple options for an updated licensure model. NASBA and AICPA leadership then used this feedback and research to develop a new approach to licensure that is responsive to stakeholder input while still propelling the profession into the future.

Q: What licensure models did NASBA and the AICPA consider? (+) Show answer

A: Some of the possibilities NASBA and the AICPA considered were:

Stretching CPA Exam and curriculum requirements to cover more material with less depth

Since the body of knowledge required of newly licensed CPAs continues to grow—but, given the current licensure model, Exam and education requirements can only cover so much information—some stakeholders suggested revising the Exam and curriculum to cover a greater range of material with less depth. However, this could water down licensure requirements, and candidates could know less about what matters most.

Increasing Exam and curriculum hours

Some stakeholders suggested increasing the content covered by licensure through methods such as adding a fifth section to the Exam or adding additional educational requirements. However, this approach could increase barriers to entry for the profession and would not be sustainable over time as increases in complexity cause the body of knowledge to continue to grow.

Discrete paths to licensure based on specialties (CPA—Audit, CPA—Tax, etc.)

Another suggestion was a licensure model with distinct paths to licensure for different types of CPAs, resulting in different designations such as CPA-Audit and CPA-Tax. However, in their feedback, the profession’s stakeholders emphasized that maintaining one unified CPA license was a priority, and that all CPAs should share a robust common core.

Two-tier licensure model

NASBA and the AICPA discussed a licensure model used by some international accountancy bodies in which CPAs are split between certificate holders and licensees who meet different requirements. However, past experience with this model in the United States showed that it can create market confusion and make certificate holders feel like second-class citizens.

Medical and legal licensure models

NASBA and the AICPA discussed licensure models similar to those of the medical and legal professions, in which greater experience or education is required before licensure. However, international accounting licensure models with a similar approach have seen higher dropout rates and lower enrollment due to the barriers to entry.

Professional Engineer (PE) licensure model

NASBA and the AICPA then considered the Professional Engineers’ (PEs) licensure model. Before licensure, engineers take two exams:

Given the stakeholder feedback NASBA and the AICPA received, the research conducted and the other options considered, this approach showed the most promise for evolving CPA licensure.

Q: Will candidates know which discipline to pick? (+) Show answer

A: Our research has indicated that candidates are comfortable selecting an area in which to focus as early as their junior year of college. In March 2020, we conducted a survey of more than 600 university students and recent graduates. Ninety percent (90%) of respondents told us they have either selected a focus area or would feel comfortable choosing a focus area.

It’s important to note that while disciplines allow candidates to demonstrate a deeper level of knowledge in one area, CPAs who achieve licensure under this model will not be restricted to practice in their selected discipline. These new CPAs will have all the rights and privileges that all CPAs have today and can practice in any area so long as they possess the required professional competence.

Q: What are some examples of the skills new CPAs will need? (+) Show answer

A: NASBA and the AICPA have heard from stakeholders across the profession that new CPAs increasingly need deeper skills and knowledge in areas such as, but not limited to:

Q: What is next for CPA Evolution? (+) Show answer

A: The AICPA Governing Council and the NASBA Board of Directors voted to support the CPA Evolution initiative. We are now moving forward with implementing the core + discipline licensure model. We expect to launch a new Uniform CPA Exam in January 2024.

NASBA and the AICPA will continue to work collaboratively with stakeholders from across the profession to implement this new licensure model. We are excited to move forward with this licensure model to meet the needs of the profession and the public.

Q: How do you expect the COVID-19 pandemic to impact the CPA Evolution initiative and timeline? (+) Show answer

A: NASBA and the AICPA are fully committed to the CPA Evolution initiative and the projected timeline. Although the COVID-19 situation is fluid; we believe this initiative is too important to delay.

If you have additional questions, please reach out to us at cpaexam@nasba.org.

As accounting educators, you’ll play a vital role in preparing students to pursue the CPA under this new licensure model. We’re here to help you every step of the way.

Check out the recording of our faculty and student webinar to learn the background of CPA Evolution. See below for resources to help accounting educators prepare for the new CPA licensure model. All of these resources are free and can be accessed by all faculty.

For more information about the proposed model and what’s coming next, read the FAQs below and download a summary of the initiative here.

For questions about the new CPA licensure model, please reach out to cpaexam@nasba.org.

Preparing students for a career in accounting is no easy task. We are here to support you each step of the way. Our new faculty hub provides you with resources to navigate the evolving profession, connect with peers and inspire your students to pursue a rewarding career in accounting. Have questions or need support? Contact us at academics@aicpa.org.

Check out our Faculty Hour webinar series for accounting educators. This free monthly webinar series includes regular updates on CPA Evolution and deep dives into emerging topics to include in accounting courses.

You can register for upcoming webinars and watch recordings of our past webinars here.

The CPA Evolution Model* Curriculum is an aid to assist faculty who want to prepare their students to become CPAs. It aligns with the CPA Evolution initiative and comprises two main components: modules, topics, and learning objectives, and examples of course offerings.

Miss the CPA Evolution Model* Curriculum Launch Event? View the recorded sessions and download the curriculum resource in PDF and Excel formats.

* Model = Example or Sample

The Accounting Program Curriculum Gap Analysis Report describes the research the AICPA and NASBA have undertaken to better understand what resources accounting educators need to help evolve their curricula. We reached out to over 1,200 university accounting department chairs across the country to ask them if their accounting programs are teaching topics such as data analytics, IT audit, cybersecurity and more. We received 317 responses from small to large accounting programs throughout the United States.

The findings in this report show us that there are major gaps in accounting education today in several crucial areas for accounting students. Where these topics are being covered, they are often being covered in only a couple of class sessions. As we expect that the new CPA Exam will cover many of these emerging topics, we are using the results from this report to inform our continued creation of faculty resources.

You can access the full report here.

The policy was recommended by the NASBA CBT Administration Committee after development and much deliberation by a task force with state board representatives from the AICPA Board of Examiners, sitting state board members and executive directors from multiple states. The State Boards of Accountancy have agreed this transition policy best serves the candidates, the state boards and the public interest. It will be effective for candidate who have started but not completed their CPA Exams when the CPA Evolution-aligned Exam launches in January 2024.

Candidates who have credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. Candidates who have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

If, however, a candidate loses credit for AUD, FAR or REG after December 31, 2023, they then must take the corresponding new Core section of AUD, FAR or REG. A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested. It is important to note that none of the sections of the current CPA Exam will be available for testing after December 31, 2023. There is a hard cutover from the current CPA Exam sections to the 2024 CPA Exam sections on the January 2024 launch.

Q: How are NASBA and the AICPA helping universities and colleges prepare for the new licensure model? (+) Show answer

A: We are developing the resources educators need in order to position their students for success. We have been actively working with the academic community to identify the resources that will aid them in this transition.

Our free Academic Resource Hub is available to help you prepare your students for the rapidly evolving demands of the profession. Signing up for the ARH will give faculty access to resources on data analytics, blockchain and much more to use in classroom instruction, research or guidance. Our resources cover a wide range of class levels and will help faculty easily incorporate new ideas into their syllabi. Accessing the ARH requires educator registration on ThisWaytoCPA.com.

Our free monthly Faculty Hour webinar series covers updates on CPA Evolution and deep dives into emerging topics with accounting faculty and expert practitioners.

The AICPA and NASBA also developed a curriculum resource to assist faculty who want to prepare their students to become CPAs. It aligns with the CPA Evolution initiative and comprises two main components: modules, topics, and learning objectives, and examples of course offerings.

Q: How many educational hours will be required for each topic on the Exam? (+) Show answer

A: We do not expect that educational hours requirements will change under the new model. However, as part of the CPA Evolution initiative, the leadership of NASBA, in collaboration with the AICPA, determined that the Uniform Accountancy Act Model Rules around educational requirements for licensure needed to be updated to incorporate additional subjects and skills reflective of the evolving profession and create more consistency. Those changes, which were endorsed by AICPA’s Board of Directors, were exposed for public comment from May 26 through August 31, 2020. NASBA issued final model rules in Fall 2020. You can find the final rules here.

Q: When will a blueprint of the content of the three disciplines be released? (+) Show answer

A: The AICPA expects to publish an exposure draft of the new Exam blueprint in mid- 2022.

Q: As an educator, what should I be doing right now? (+) Show answer

A: Share information about CPA Evolution with your department heads, advisory boards and all your accounting faculty. You can access our CPA Evolution flyer here. Use the resources on the Academic Resource Hub to begin integrating new topics in your courses now. We have over 300 resources available from the AICPA, firms and accounting faculty in topics like data analytics and cybersecurity, and we will continue to add more. Check out the curriculum resource as you work to review and update your curricula.

Q: Where can I find updates on all the resources for educators? (+) Show answer

A: Faculty can sign up for the Extra Credit Newsletter and join the AICPA’s Academics LinkedIn Group. You can continue to find updates here on EvolutionofCPA.org as well as on the Academic Resource Hub on This Way to CPA.

Q: What is the CPA Evolution Model Curriculum? (+) Show answer

A: In June 2021, the AICPA and NASBA released the CPA Evolution Model Curriculum (the curriculum resource). Our goal was to aid faculty as they seek to transition their programs to reflect the new Core + Disciplines CPA licensure model promoted through the CPA Evolution initiative. More than 40 volunteer subject-matter experts worked to develop this resource, which was designed to prepare students pursuing CPA licensure. We launched the curriculum resource during a free, virtual event with over 1,500 attendees. Since the launch, the curriculum resource has been downloaded over 3,500 times.

You can download the curriculum resource in both PDF and Excel here as well as view more FAQs.

Q: Will students be interested in pursuing CPA licensure under the new licensure model?(+) Show answer

A: The AICPA and NASBA conducted a survey of accounting students to answer this question, and the responses we received were very promising.

Forty-seven percent of accounting students said the CPA Evolution licensure model would increase their interest in becoming a CPA. Another 33% said they are already very interested in becoming licensed, and CPA Evolution would do nothing to dissuade them. Four percent of respondents told us they are not very interested in CPA licensure under the current model and that CPA Evolution did not impact their interest, and 16% said they would be less interested in licensure under the Evolution model.

We asked the “less interested” group to explain their thinking, and themes in responses indicated a lack of understanding the new CPA licensure model. For example, some respondents believed they would only be acquiring and demonstrating competence in their chosen discipline. This represents an opportunity for AICPA and NASBA to provide further clarity.

We saw a similar result when considering the interest of non-accounting majors, including MIS, finance and business analytics majors. Fifty percent indicated CPA Evolution would increase their interest in CPA, with only 11% indicating their interest would decrease.

Q: Which discipline will students select? (+) Show answer

The AICPA and NASBA recently conducted a student pulse survey that asked respondents to rank which discipline they would be most likely to pursue. The survey indicated that about 50% of students would select Business Analysis and Reporting, 25% would select Information Systems and Controls and 25% would select Tax Compliance and Planning.

All three disciplines will be rigorous. However, based on a student’s interests, skillset and preparation, a student may find one discipline easier than another. Students should be encouraged to pursue the discipline that best aligns with their initial intended area of practice.

Q: What should I be telling my students? (+) Show answer

Direct your students to the “For Students and Candidates” tab on EvolutionofCPA.org. Students can view a recorded webinar explaining CPA Evolution, FAQs and more. Encourage your students to sign up on This Way to CPA to get regular communications about CPA Evolution.

The AICPA and NASBA will hold additional webinars for students and will share the information with educators so that you can encourage your students to register.

Q: Will public accounting firms value students that graduate from accounting programs aligned with CPA Evolution?(+) Show answer

To study this question, the AICPA and NASBA surveyed hiring directors and Chief Operating Officers at accounting firms with eleven or more CPAs. Survey participants were asked to imagine that every accounting program had instituted revisions to their curricula to align with the CPA Evolution initiative. We described the CPA Evolution Model Curriculum, including the high-level topics addressed in the Core and each elective Discipline track, and asked how such an approach to accounting education might affect the firms’ decision making.

Eighty-three percent of respondents indicated their hiring of new graduates from accounting programs would likely increase, accounting program graduates would be considered more valuable than they are today, or both.

Q: How are the AICPA and NASBA engaging textbook publishers? (+) Show answer

A: We’ve had ongoing dialogue with several of the major textbook providers and we are happy to report that they and their authors are committed to updating their offerings to meet the needs of faculty and prepare students for the practice environment.

If you have additional questions, please reach out to us at cpaexam@nasba.org.

It’s never been a more exciting time to pursue the CPA license. The role of today’s CPA has evolved, and newly licensed CPAs are taking on new responsibilities that were traditionally assigned to more experienced staff. Becoming a CPA means you’ll need deeper skill sets, more competencies and a greater knowledge of emerging technologies. That’s why the CPA licensure model is changing.

Aspiring CPAs who are college freshmen now will be among the first to take the overhauled version of the Uniform CPA Examination when it launches in 2024. However, if you’ve already started the CPA licensure process by then, don’t worry. Current CPA candidates will be able to sit for the current CPA Exam until the launch of the new Exam, and a transition plan will be developed for candidates who have started, but not completed, the CPA Exam process by January 2024.

For more information on becoming a CPA, please visit This Way to CPA.

For any questions on the new CPA licensure model, please reach out to us at cpaexam@nasba.org.

Check out our latest student webinar to learn what CPA Evolution means for you.

NASBA has announced the transition policy for the new Exam launching in January 2024. If you anticipate continuing your CPA Exam journey into 2024 and beyond, the following transition policy will apply to you.

Candidates who have credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. Candidates who have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

If, however, a candidate loses credit for AUD, FAR or REG after December 31, 2023, they then must take the corresponding new Core section of AUD, FAR or REG. A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested. It is important to note that none of the sections of the current CPA Exam will be available for testing after December 31, 2023. There is a hard cutover from the current CPA Exam sections to the 2024 CPA Exam sections on the January 2024 launch.

Q: When will the new CPA Exam be ready? (+) Show answer

A: We expect to launch the new Exam in January 2024.

Q: How will CPA Evolution affect current CPA candidates? (+) Show answer

A: Current CPA candidates will still be able to sit for the current CPA Exam until the launch of the Evolution-aligned CPA Exam in 2024. NASBA has announced a transition policy for candidates who have started, but not completed, the CPA Exam process by January 2024

Q: What will be included in the core? (+) Show answer

A: NASBA and the AICPA anticipate that not all of the content covered by the current CPA Exam and curricula will be considered “core” under the new licensure model. Instead, certain advanced content in the current core could be incorporated into the disciplines.

The specific content of the core and disciplines will be determined by state board education requirements and a CPA Exam practice analysis. As a part of its ongoing efforts to maintain the validity and reliability of the Exam, the AICPA conducts periodic practice analyses to gather information about the current state of the profession and the work of newly licensed CPAs. These research initiatives inform potential changes and updates to the CPA Exam and maintain its alignment with professional practice. An upcoming practice analysis will determine the specific content and skills tested in the Exam for the core and the disciplines.

Q: What is a discipline? (+) Show answer

A: Under the new licensure model, the Uniform CPA Examination will consist of three core sections and the candidate’s choice of one of three discipline sections. A candidate will be required to pass three core sections and one discipline section to meet the Exam requirements for licensure.

The discipline sections provide an opportunity for candidates to demonstrate a deeper level of knowledge in one pillar of the profession but will not prevent candidates from practicing outside that discipline once licensed. The three disciplines are Business Analysis and Reporting (BAR), Tax Compliance and Planning (TCP), and Information Systems and Controls (ISC).

Q: Are the names of the disciplines final, or could they change?(+) Show answer

A: The names of the disciplines and the Exam sections in the core have been established. The core sections are Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Taxation and Regulation (REG). The disciplines are Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). That said, in the future, this model would allow for the flexibility to add or remove core and discipline sections to reflect the reality of practice and protect the public interest.

Q: What percentage of the Exam will fall under the core vs. the disciplines? (+) Show answer

A: Ultimately, the allocation of content of the core and disciplines will be determined through a CPA Exam practice analysis. As a part of its ongoing efforts to maintain the validity and reliability of the Exam, the AICPA conducts periodic practice analyses to gather information about the current state of the profession and the work of newly licensed CPAs. These research initiatives inform potential changes and updates to the CPA Exam and maintain its alignment with professional practice.

Q: After I take the core, am I a CPA? Are the disciplines optional? (+) Show answer

A: Completing a discipline is not optional. All candidates will be required to pass the three sections of the core AND one discipline section to meet the Exam requirements for licensure.

Q: How long will the new CPA Exam be? How many sections does a candidate have to pass? (+) Show answer

A: We expect the Exam will still be no more than 16 hours and candidates will still be required to pass four sections in total (including their chosen discipline). The length of each section of the Exam will be determined through a CPA Exam practice analysis. The AICPA Examinations team maintains the professional currency of the CPA Exam through periodic practice analyses that review changes happening in the profession today and into the future, and essential knowledge andskills testing for the protection of the public interest.

Q: Will candidates who become CPAs under this model be able to practice outside of their chosen discipline? (+) Show answer

A: Yes, given they have the required competence.

Regardless of chosen discipline, this model leads to a full CPA license, with rights and privileges consistent with any other CPA. This includes rights to sign audit and attest reports, as the core will give every candidate a strong base in accounting, auditing, tax and technology.

However, ethical requirements dictate that CPAs only undertake those professional services that they can reasonably expect to complete with professional competence. Competence means the CPA or their staff possess the appropriate technical qualifications to perform the professional service and that, as required, the CPA supervises and evaluates the quality of work performed.

If you have additional questions, please reach out to us at cpaexam@nasba.org.

The AICPA conducts practice analyses to ensure the CPA Exam remains aligned with the professional practice. The research helps confirm the relevant knowledge and skills to be assessed. The CPA Evolution initiative requires the development of a new CPA Exam with a Core and Disciplines structure and content.

As with any substantive change proposed for the CPA Exam, the AICPA must conduct a practice analysis to ensure it remains aligned with the professional practice of newly licensed CPAs. This research helps confirm the relevant knowledge and skills the CPA Exam must assess.

During the practice analysis, the AICPA will engage with subject matter experts and other stakeholders to determine the appropriate content to be assessed in the Core and Discipline sections. Information and progress will be shared periodically throughout the practice analysis and requests will be made for public input.

All practice analysis questions should be directed to the AICPA Examinations team.

You can check out more information about the practice analysis here.